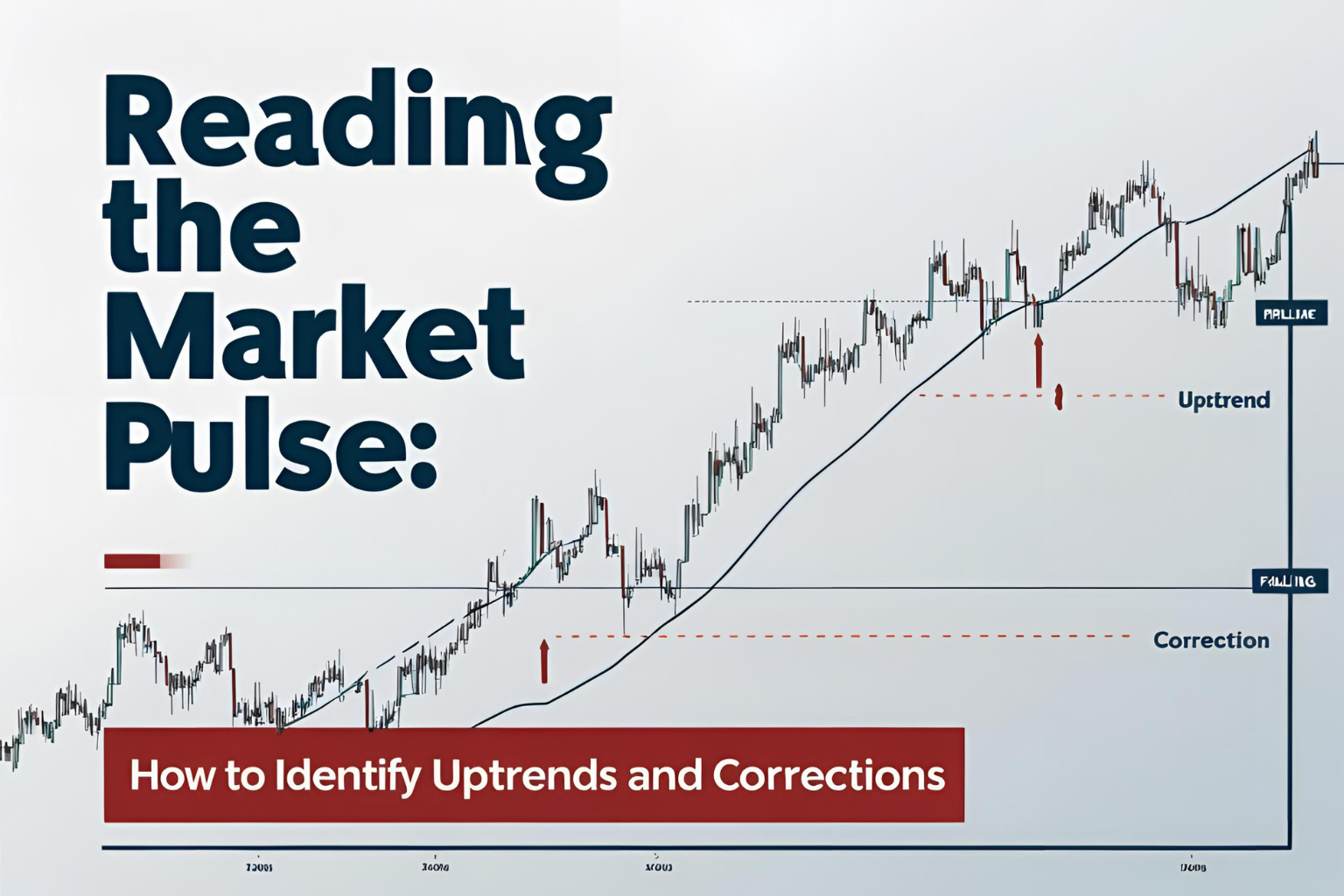

Reading the Market Pulse: How to Identify Uptrends and Corrections

Understanding market direction is critical for successful investing. Investor’s Business Daily (IBD) stresses the importance of accurately identifying market uptrends and corrections. By doing so, you can position your portfolio for maximum gains and minimize losses during downturns.

In this guide, you’ll learn how to effectively read the market pulse and make better investment decisions.

Why Market Direction Matters

Even the best stocks usually follow the market’s overall trend. Buying during market uptrends and stepping aside during corrections can dramatically improve your investment performance.

Here’s how to clearly identify these trends.

How to Identify a Market Uptrend

A market is typically considered in an uptrend when:

- Major indexes (like the S&P 500 or Nasdaq) consistently close higher.

- Leading stocks break out on strong volume.

- Market breadth improves significantly (more stocks rising than falling).

In an uptrend, it’s safer to buy growth stocks breaking out of strong chart patterns.

Learn about chart patterns:

➡️ Top 5 Chart Patterns Every Growth Investor Should Know

How to Recognize a Market Correction

A market correction typically involves:

- Major indexes falling around 10–20% from recent highs.

- Heavy selling volume on down days, indicating institutional selling.

- Few breakouts working and many leading stocks breaking down.

During corrections, reduce exposure, avoid new purchases, and protect capital.

Master risk management:

➡️ Risk Management 101: Cutting Losses Quickly and Safely

Tools for Tracking Market Trends

Use these tools to stay on top of market trends:

- IBD Market Pulse: Daily market status updates (Confirmed Uptrend, Market Under Pressure, Correction).

- MarketSmith: Detailed market analysis with clear indicators of market health.

- TradingView: Real-time market charts and technical indicators like moving averages.

Key Signals to Confirm a Market Change

IBD’s methodology highlights important market signals:

- Follow-Through Day: A significant up day (indexes up strongly with higher volume) confirms a new uptrend after a correction.

- Distribution Days: Heavy-volume down days in indexes indicate possible market weakness or upcoming correction.

Always wait for a Follow-Through Day before aggressively buying after corrections.

Common Mistakes in Identifying Market Trends

Avoid these common errors:

- Buying prematurely before a confirmed market uptrend.

- Ignoring distribution days, leading to missed signs of market weakness.

- Holding onto losers during corrections, hoping for a reversal.

Stay disciplined with investing rules:

➡️ 7 Golden Rules from IBD for Successful Investing

Putting It All Together: Quick Market Trend Checklist

- ✔️ Check major indexes daily.

- ✔️ Confirm market status (IBD Market Pulse).

- ✔️ Watch leading stocks and sectors closely.

- ✔️ Adjust portfolio positions based on confirmed market trends.

Final Thoughts

Learning to read market uptrends and corrections effectively is crucial for successful investing. By understanding and acting on market signals, you’ll be better equipped to buy leading stocks at the right time and preserve your capital during market downturns.

FAQs

What is a market uptrend?

A sustained period where major market indexes consistently move higher, supported by strong buying volume.

How do I spot a market correction?

A correction typically involves indexes dropping about 10–20% with heavy selling volume and limited successful breakouts.

Why should investors follow market trends?

Because most stocks follow the market direction, investing during uptrends and avoiding corrections improves returns.

What is an IBD Follow-Through Day?

An up day with significantly higher volume confirming a new market uptrend after a correction.

What tools help monitor market trends?

IBD Market Pulse, MarketSmith, and TradingView are excellent resources to track market health.