The Importance of Market Direction in IBD Investing

Market direction is often the missing piece of the puzzle for growth investors. Investor’s Business Daily (IBD) emphasizes that understanding market trends—uptrends, corrections, and sideways markets—is essential for success in investing.

This article explains why market direction matters so much in the IBD method and how mastering it can enhance your investing outcomes.

Why Does Market Direction Matter?

Market direction matters because roughly 3 out of 4 stocks move in the same direction as the overall market. No matter how good your stock picks are, ignoring market direction can lead to avoidable losses or missed opportunities.

- Uptrends offer the best environment for growth stocks to thrive.

- Corrections mean most stocks lose value, even strong companies.

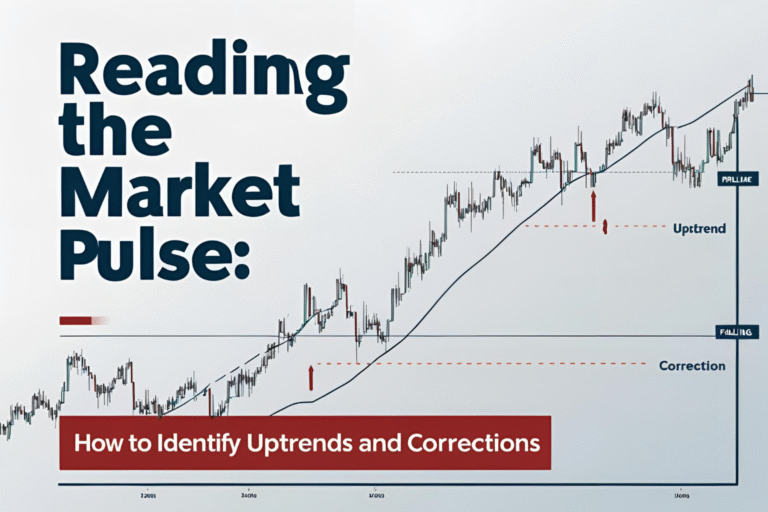

How IBD Defines Market Direction

IBD classifies market direction clearly into three main states:

- Confirmed Uptrend: Market is rising consistently with strong buying volume; ideal conditions for new purchases.

- Market Under Pressure: Market shows mixed signals with increased volatility; caution advised.

- Market Correction: Market indices fall sharply (10–20%); avoid new buys and protect capital.

Learn more about recognizing trends:

➡️ Reading the Market Pulse: How to Identify Uptrends and Corrections

How Market Direction Influences Buy and Sell Decisions

Understanding market trends directly affects your investing actions:

- During an uptrend: Actively buy stocks at breakout points.

- During market pressure: Be cautious, reduce new positions, and tighten stop-losses.

- During corrections: Sell weak positions quickly, stay on the sidelines, and wait for a confirmed uptrend signal (Follow-Through Day).

Master risk management:

➡️ Risk Management 101: Cutting Losses Quickly and Safely

Market Direction and Portfolio Management

IBD investors typically adjust their portfolio exposure based on market trends:

- Confirmed Uptrend: 75–100% invested.

- Market Under Pressure: Reduce exposure to about 50–75%.

- Market Correction: Reduce to minimal exposure or even 100% cash.

This disciplined approach helps preserve gains and minimize losses.

Common Mistakes with Market Direction

Avoid these common errors:

- Ignoring market signals: Staying fully invested during corrections can lead to significant losses.

- Jumping in too early: Investing heavily before a confirmed market uptrend often results in getting stopped out.

- Failing to reduce exposure: Keeping full exposure during volatile or uncertain markets increases risk unnecessarily.

Follow disciplined rules for better outcomes:

➡️ 7 Golden Rules from IBD for Successful Investing

Key Tools to Monitor Market Direction

Leverage these popular tools to track market direction:

- IBD Market Pulse: Offers daily updates clearly showing current market status.

- MarketSmith: Provides detailed market analysis, distribution days, and Follow-Through Day signals.

- TradingView: Charts and technical indicators to visually track market health and trends.

Final Thoughts

Recognizing and respecting market direction in IBD investing is vital. When combined with sound stock selection and disciplined trading rules, this awareness significantly improves your investment performance, keeping you ahead of the market’s big moves.

FAQs

Why is market direction important in IBD investing?

Because most stocks follow the general market trend, investing according to market direction helps optimize returns and manage risk.

What should I do during a market correction?

Protect capital by cutting losses quickly, avoid new buys, and wait patiently for a confirmed market uptrend.

When is the best time to buy stocks according to IBD?

During a confirmed market uptrend, ideally right after a Follow-Through Day confirming a new uptrend.

How does market direction impact portfolio exposure?

Exposure should increase during uptrends and decrease during market pressure or corrections to manage risk effectively.

Which tools help track market direction effectively?

IBD Market Pulse, MarketSmith, and TradingView are recommended for timely market trend analysis.