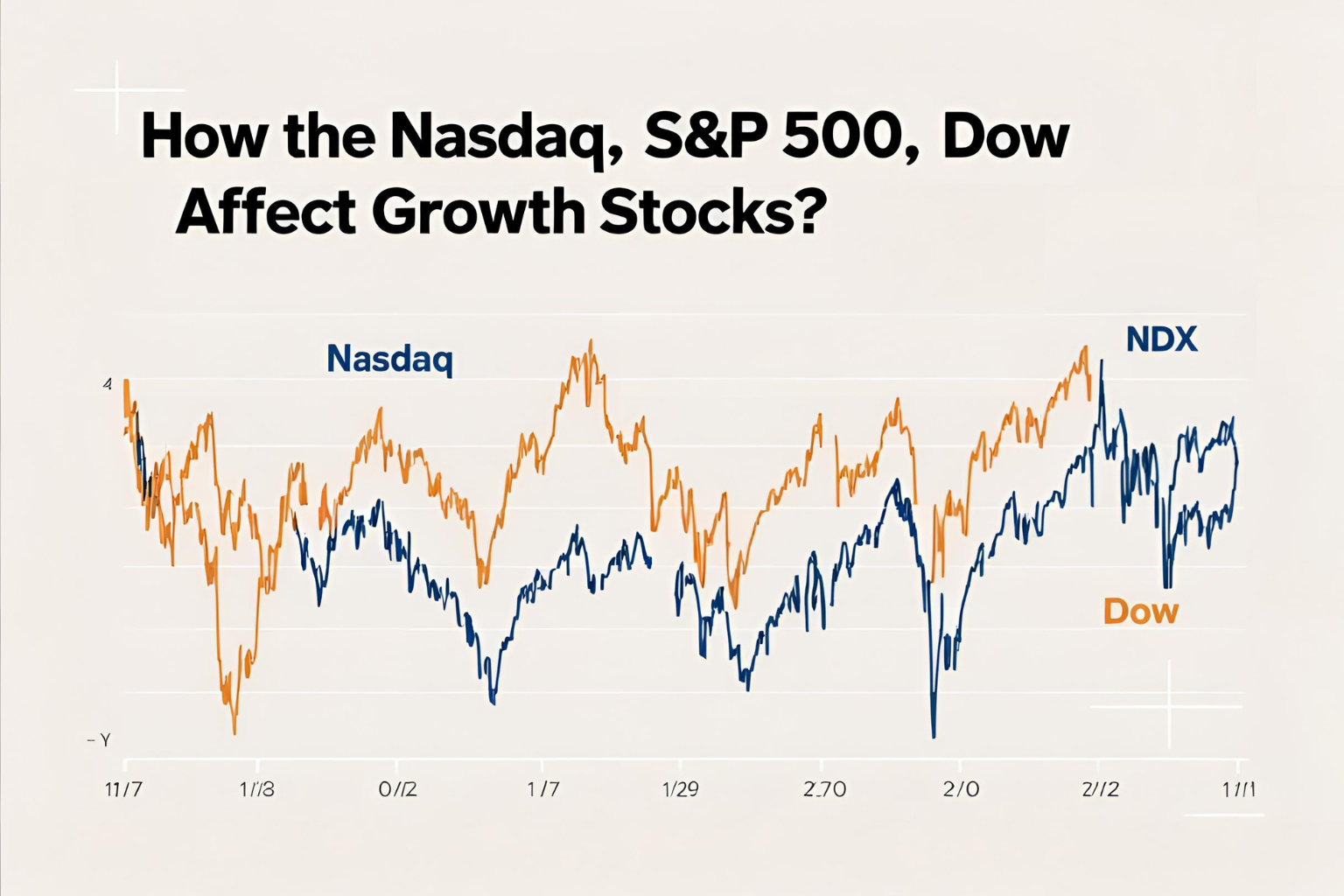

How the Nasdaq, S&P 500, and Dow Affect Growth Stocks

If you’re using IBD’s growth investing approach, it’s critical to monitor major U.S. indexes: the Nasdaq, S&P 500, and Dow Jones Industrial Average. These indexes not only reflect the overall market health, but also signal when to buy, hold, or sell growth stocks.

In this guide, we’ll explain how each index works and how their movements can directly influence your CAN SLIM-style investing strategy.

1. The Nasdaq Composite: The Growth Stock Index

The Nasdaq Composite Index is heavily weighted with tech and growth companies like Apple, Amazon, and NVIDIA. It’s the most relevant index for CAN SLIM investors.

Why it matters:

- Many leading growth stocks are listed here.

- IBD uses the Nasdaq’s behavior to determine market trends.

- Strong uptrends in the Nasdaq often signal ideal buying windows.

Learn to spot trend shifts:

➡️ Reading the Market Pulse: How to Identify Uptrends and Corrections

2. The S&P 500: Broad Market Health Indicator

The S&P 500 includes 500 large-cap companies across all sectors. While more balanced than the Nasdaq, it still includes many growth names.

Why it matters:

- IBD also tracks the S&P 500 to confirm market direction.

- Corroborating uptrends in both Nasdaq and S&P 500 adds strength to trend confirmation.

- It gives a broader view of institutional behavior.

3. The Dow Jones Industrial Average: Blue-Chip Benchmark

The Dow includes 30 large, mature companies like Coca-Cola, Boeing, and Microsoft.

Why it matters:

- It’s less relevant for growth investors but helps gauge macro sentiment.

- A divergence between the Dow and Nasdaq can signal sector rotation or shifts in market leadership.

Using Index Action in Your Strategy

Here’s how index performance impacts your decisions:

| Index Behavior | Investor Action |

|---|---|

| Nasdaq & S&P 500 in Uptrend | Look for breakouts, initiate positions |

| Market Under Pressure | Scale back exposure, tighten stops |

| Correction Mode | Avoid new buys, raise cash |

Apply this with discipline:

➡️ The Importance of Market Direction in IBD Investing

Common Mistakes to Avoid

- Focusing only on individual stocks without watching index trends.

- Relying solely on the Dow, which may lag or diverge from growth-focused indices.

- Buying aggressively during corrections, when major indexes are trending down.

Final Thoughts

The movements of the Nasdaq, S&P 500, and Dow give you the context you need to make smart decisions. In IBD investing, understanding index action is as critical as picking the right stock. Always trade in sync with the broader market trend.

FAQs

Which index is most important for growth stocks?

The Nasdaq Composite is most relevant for growth investors using the CAN SLIM method.

Should I watch all three indexes daily?

Yes, but give extra attention to the Nasdaq and S&P 500. Use the Dow for overall sentiment only.

Can a strong Nasdaq rally signal a new uptrend?

Yes—especially when paired with a Follow-Through Day and increasing volume.

What if the Dow is weak but Nasdaq is strong?

That’s okay for growth investing. Nasdaq leadership is more important in the IBD system.

How do I know when to buy based on index action?

Use IBD’s Market Pulse and monitor for a Follow-Through Day as a signal to begin buying.