How to Spot Sector Rotation in the Stock Market

One of the most important concepts for IBD investors to understand is sector rotation—when money flows out of one sector and into another. Recognizing this early helps you stay aligned with market leadership and avoid lagging areas.

In this guide, we’ll explain what sector rotation is, how to spot it, and how to apply it to your growth stock strategy.

What Is Sector Rotation?

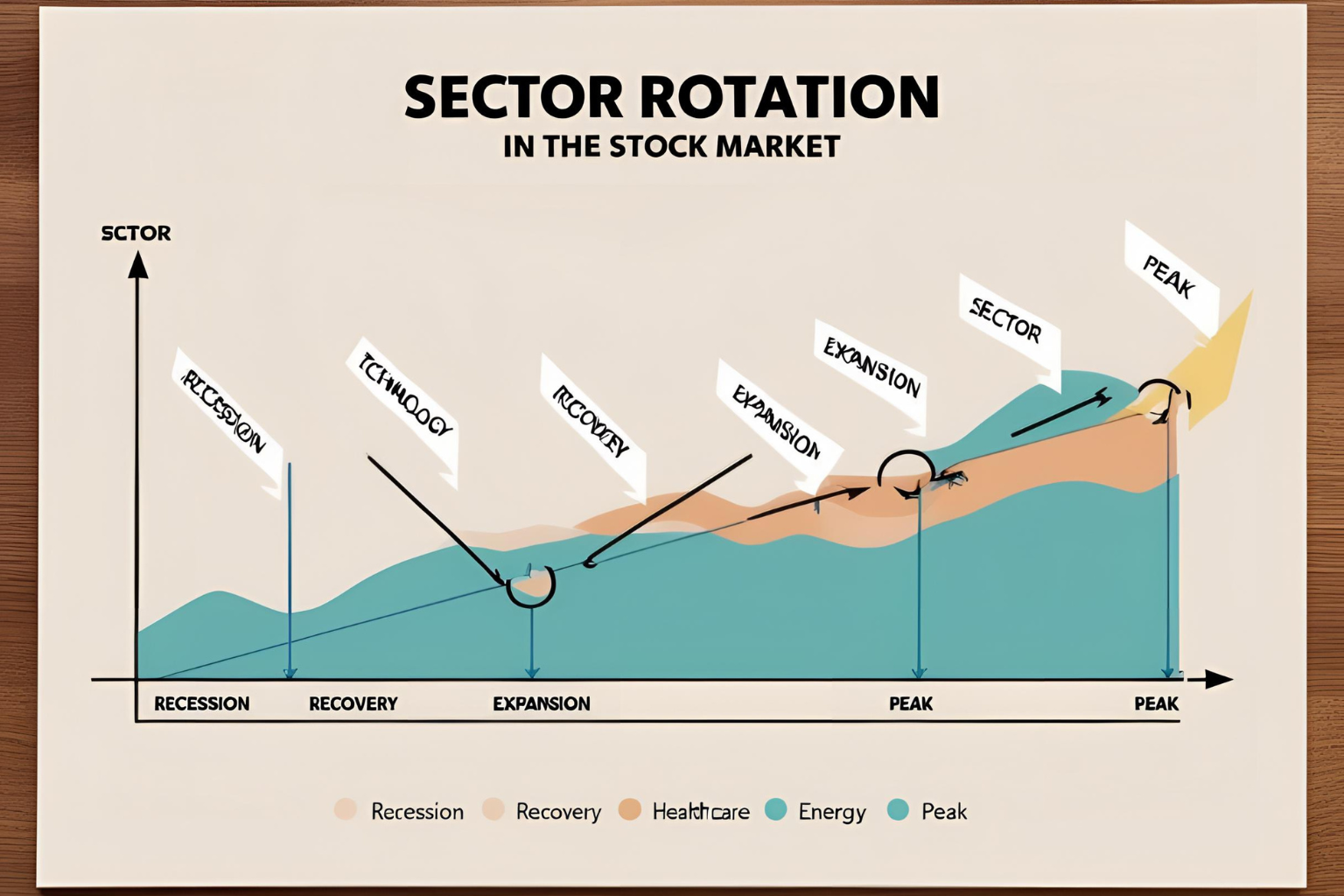

Sector rotation is the movement of institutional capital from one industry or sector to another based on market cycles, interest rates, or economic data.

For example:

- From technology to energy

- From consumer discretionary to utilities

- From growth to defensive stocks

This shift affects where leadership forms and which stocks are likely to outperform.

Why Sector Rotation Matters for Growth Investors

IBD investing is about buying leading stocks in leading sectors. If you’re holding growth stocks in sectors that are falling out of favor, your performance will suffer—even if the overall market is rising.

Understanding sector rotation helps you:

- Stay in sync with institutional money flow.

- Anticipate breakouts in new sectors.

- Exit weakening industries before losses pile up.

Learn to build stronger watchlists:

➡️ How to Build a Winning Watchlist of Growth Stocks

How to Spot Sector Rotation Early

Here are key signs to watch:

1. Index Divergence

If the Nasdaq is rising but the Dow or S&P 500 is lagging (or vice versa), it can signal a shift in leadership between growth and defensive sectors.

Explore more here:

➡️ How the Nasdaq, S&P 500, and Dow Affect Growth Stocks

2. Relative Strength Shifts

Use Relative Strength (RS) ratings to spot sectors gaining momentum. Stocks in sectors with rising RS ratings often become new leaders.

3. Volume and Breakouts

Look for breakouts in new sectors happening on high volume. It often indicates fresh institutional buying.

4. Sector ETFs

Watch ETFs like:

- XLK (Tech)

- XLF (Financials)

- XLE (Energy)

- XLV (Healthcare)

Their chart patterns can show where money is flowing.

How to React to Sector Rotation

- Adjust your watchlist: Focus on top-performing sectors only.

- Exit lagging industries: Even if your stock has good fundamentals.

- Be flexible: IBD investing rewards adaptability—not stubbornness.

Maintain strong discipline:

➡️ 7 Golden Rules from IBD for Successful Investing

Final Thoughts

Spotting sector rotation early helps you stay ahead of the market and ride new waves of leadership. By using tools like RS ratings, ETF analysis, and price/volume action, you can shift your portfolio in time and boost your returns with the market’s strongest sectors.

FAQs

What is sector rotation in the stock market?

It’s the flow of money from one sector to another, often in response to economic cycles, interest rates, or market trends.

Why should IBD investors care about sector rotation?

Because IBD focuses on leading stocks in leading sectors. Ignoring sector shifts can lead to underperformance.

How do I identify sector rotation?

Monitor index divergence, relative strength shifts, sector ETF performance, and breakout volume trends.

How often does sector rotation happen?

It varies. Some rotations are short-term (weeks), while others align with economic cycles (months or quarters).

Can I use technical indicators to track sector strength?

Yes—RS ratings, moving averages, and volume analysis on sector ETFs are helpful tools.